How I Predict Markets Without Guessing—My Early Retirement Playbook

What if you could retire early not by taking wild risks, but by seeing market shifts before they happen? I’m not a Wall Street insider—I’m just someone who learned to read the signals. After years of trial, error, and one major wake-up call, I built a strategy that blends patience, pattern recognition, and smart positioning. This isn’t about timing the market perfectly; it’s about staying ahead with confidence. Here’s how I do it—and how you can too.

The Retirement Dream That Felt Impossible

For most of my working life, early retirement seemed like a fantasy reserved for the exceptionally wealthy or those who won big in tech startups. I watched colleagues chase high-risk investments, hoping for a windfall that never came. I myself worked long hours, saved what I could, and still felt like financial freedom was out of reach. The turning point came after a market correction wiped out nearly 20% of my portfolio in just a few months. That experience forced me to rethink everything—not just how I invested, but what retirement really meant.

I realized that early retirement wasn’t about quitting work at 50 with a million dollars. It was about creating a sustainable lifestyle funded by reliable income, not constant capital growth. The goal shifted from accumulating wealth to preserving and intelligently deploying it. That’s when I stopped focusing solely on returns and began studying the conditions under which markets rise, fall, and reset. I started asking not “How much can I make?” but “How can I avoid losing what I’ve built?” This mental shift was the foundation of everything that followed.

Financial independence, I discovered, is less about income level and more about expense control, portfolio durability, and the ability to anticipate change. I began to see my portfolio not as a collection of stocks and bonds, but as a living system that responded to economic rhythms. By aligning my strategy with those rhythms—rather than fighting them—I created a path forward. The dream no longer felt impossible. It felt like a matter of discipline, observation, and time.

Why Market Prediction Isn’t Just for Experts

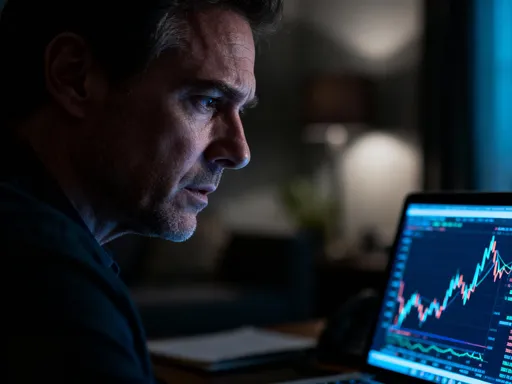

Many people assume that predicting market movements requires advanced degrees, expensive software, or insider information. But in reality, the most valuable insights often come from observing simple, publicly available data with consistency and curiosity. I didn’t start with complex algorithms or economic models. I began by tracking three things: consumer confidence reports, interest rate trends, and earnings season outcomes. These weren’t secret indicators—anyone could access them. What mattered was how I interpreted them over time.

For example, I noticed that in the months leading up to a downturn, consumer spending often plateaued even as stock prices continued to climb. At first, this seemed contradictory. But when I dug deeper, I saw that rising stock valuations were being driven more by sentiment than fundamentals. Similarly, when interest rates began to rise after a long period of stability, I observed that high-growth tech stocks were the first to weaken—even before official economic data confirmed a slowdown. These weren’t isolated events. They were patterns.

What set my approach apart wasn’t superior knowledge, but consistent attention. While others reacted to headlines, I focused on context. When a major tech company reported strong earnings but gave weak future guidance, I didn’t jump on the rally. Instead, I watched how other companies in the sector responded. If several followed with similar caution, it signaled broader uncertainty. That awareness allowed me to reduce exposure before the sector corrected. Market prediction, I learned, isn’t about being right all the time. It’s about being prepared more often than not.

Over time, these observations became a framework. I didn’t need to predict exact turning points. I just needed to recognize when the odds were shifting. And that small edge—gained through observation, not speculation—became the cornerstone of my strategy.

Building a Signal-Based Strategy (Not a Crystal Ball)

One of the biggest mistakes investors make is treating market forecasting like fortune-telling. They search for a single indicator that will reveal the future with certainty. But no such signal exists. Instead of chasing perfection, I built a strategy based on probabilities. My goal isn’t to know exactly where the market will go, but to increase the likelihood of being on the right side of major moves.

I focus on leading indicators—data points that tend to shift before broader market trends become obvious. Bond yields are one of my most reliable tools. When long-term Treasury yields rise steadily, it often signals growing inflation expectations or tighter monetary policy. Historically, this environment tends to pressure growth stocks and favor value-oriented sectors. I don’t act on a single data point, but when bond yields, credit spreads, and inflation expectations all move in the same direction, the signal strengthens.

Another key indicator is job market momentum. A strong labor market supports consumer spending, which fuels corporate earnings. But when job growth becomes too rapid, it can trigger concerns about wage-driven inflation, leading the Federal Reserve to raise interest rates. I track not just the headline unemployment rate, but also wage growth, labor force participation, and job openings. These nuances help me assess whether the economy is expanding sustainably or overheating.

Global capital flows also provide valuable clues. When money moves out of emerging markets and into U.S. Treasuries, it often reflects rising risk aversion. I monitor foreign central bank holdings, currency exchange rates, and cross-border investment trends. These aren’t flashy headlines, but they reveal where institutional investors are positioning themselves—often months before retail investors notice.

When multiple signals align—rising bond yields, slowing job growth, and capital flight from riskier assets—I adjust my portfolio accordingly. I don’t make drastic changes, but I gradually reduce exposure to vulnerable areas and increase allocations to defensive sectors or cash. This approach isn’t about fear. It’s about positioning with intention. Over the past decade, this method has helped me avoid major drawdowns and capture gains during recoveries—without ever trying to time the market perfectly.

Risk Control: The Real Engine of Early Exit

Many investors focus on returns, but the truth is that risk management is what makes early retirement possible. A single major loss can erase years of gains and delay financial independence by a decade or more. I learned this the hard way during the 2008 crisis, when I watched a well-diversified portfolio still lose more than 35% of its value. That experience taught me that diversification alone isn’t enough. You need active risk controls.

My first line of defense is position sizing. I limit exposure to any single asset class—whether U.S. stocks, international equities, or real estate—to no more than 25% of my portfolio. Within each category, I further diversify across sectors and geographies. This ensures that no single event can devastate my overall wealth. For example, if the tech sector crashes, it might hurt a portion of my holdings, but it won’t threaten my entire retirement plan.

Second, I use trailing stops to protect gains. When an investment appreciates by a certain percentage—typically 15% to 20%—I set a trailing stop that locks in profits if the price falls. This isn’t about maximizing returns; it’s about preserving them. I’ve seen investors hold onto winning positions too long, only to give back all their gains when the market turns. A trailing stop removes emotion from the decision. It’s an automatic safeguard.

Perhaps most importantly, I stress-test my portfolio against historical downturns. I simulate how my current allocation would have performed during the 2000 dot-com crash, the 2008 financial crisis, and the 2020 pandemic sell-off. If the projected loss exceeds 30%, I adjust. This doesn’t mean I avoid risk altogether—I accept that volatility is part of investing. But I want to know, with confidence, that I can survive a major shock without changing my lifestyle.

These controls may seem conservative, even boring. But they’re what allow me to stay invested during turbulent times. While others panic and sell at the bottom, I remain calm, knowing my portfolio is designed to endure. Risk management isn’t the glamorous part of investing, but it’s the most powerful. It’s not the rocket fuel of returns—it’s the seatbelt that keeps you safe on the journey.

The Income Puzzle: Living Off Your Portfolio Without Breaking It

Retiring early isn’t just about leaving your job. It’s about replacing your paycheck with reliable, sustainable income. The challenge isn’t building wealth—it’s spending it wisely. I’ve seen too many people retire with substantial portfolios only to deplete them within a decade because they withdrew too much too soon. My goal was different: to create an income engine that could last 30 years or more, regardless of market conditions.

I built a diversified income strategy that combines multiple sources. First, I invest in dividend growth stocks—companies with a long history of increasing payouts year after year. These aren’t flashy tech names, but stable businesses in sectors like consumer staples, utilities, and healthcare. They provide a steady cash flow that tends to rise with inflation, helping preserve purchasing power over time.

Second, I use a covered call strategy on a portion of my holdings. This involves selling call options on stocks I already own, collecting premiums in exchange for agreeing to sell at a higher price. It’s not a get-rich-quick scheme—it caps my upside, but it generates consistent income and can reduce volatility. In flat or slightly declining markets, this strategy adds meaningful returns without taking on excessive risk.

Third, I allocate a portion of my portfolio to real estate. Not speculative flips or short-term rentals, but long-term rental properties in stable markets. These generate monthly cash flow and have appreciated steadily over time. Real estate also provides a hedge against inflation, as rents and property values tend to rise when the cost of living increases.

My withdrawal strategy is equally important. I follow a flexible rule: I aim to withdraw no more than 3% to 4% of my portfolio annually, adjusted for market performance. In strong years, I may take a little more. In weak years, I reduce spending and rely more on non-correlated income sources, like rental cash flow or fixed-income investments. This flexibility allows me to maintain my lifestyle without jeopardizing long-term sustainability.

The key is balance. No single income source carries the entire burden. When one underperforms, others compensate. This diversification doesn’t eliminate risk, but it smooths out the ride. As a result, I can enjoy retirement without constantly worrying about the next market dip.

Practical Moves Anyone Can Start Today

You don’t need a million dollars to begin building a strategy like this. I started with less than $50,000 and a full-time job. What mattered wasn’t the size of my initial investment, but the consistency of my actions. The most powerful financial tools aren’t complex—they’re simple, repeatable habits that compound over time.

My first step was automating my investments. Every paycheck, a fixed amount went into my brokerage and retirement accounts. I didn’t wait for the “perfect moment” to invest. I bought consistently, regardless of market conditions. This approach, known as dollar-cost averaging, reduced my exposure to timing risk and helped me build discipline.

Next, I committed to tracking just three economic reports each month: the Consumer Price Index (CPI), the jobs report (non-farm payrolls), and the Federal Reserve’s interest rate decision. I didn’t analyze them deeply at first—just noted the trends over time. After six months, patterns began to emerge. I saw how rising inflation often preceded interest rate hikes, which in turn affected bond prices and stock valuations. This basic awareness gave me a framework for making informed decisions.

I also set price alerts for key levels in the markets I followed. Instead of watching charts every day, I received notifications when major indices or sectors hit certain thresholds. This allowed me to stay informed without becoming obsessive. I reviewed my portfolio quarterly, rebalancing if any asset class had drifted more than 5% from its target allocation. This small act kept my risk profile consistent.

Finally, I focused on reducing unnecessary expenses. I didn’t live frugally to the point of deprivation, but I eliminated wasteful spending—expensive subscriptions, impulse purchases, dining out too often. The savings went straight into investments. Over time, these small choices added up. The power wasn’t in any single action, but in their repetition. Anyone can start this way. You don’t need to be rich. You just need to be consistent.

Staying Ahead: Adapting Without Chasing

Markets change. Economic conditions evolve. What worked five years ago may not work today. That’s why I review my entire investment framework every quarter. I don’t do this to overhaul my strategy every few months, but to ensure it’s still aligned with current realities. I ask myself a series of questions: Are the indicators I rely on still reliable? Is investor sentiment driven by fundamentals or emotion? Am I holding onto past successes out of habit rather than conviction?

This process isn’t about chasing the latest trend. In fact, it’s the opposite. It’s about avoiding the trap of confirmation bias—seeing only what you want to see. I deliberately seek out data that challenges my assumptions. If I’m bullish on a sector, I read bearish analyses. If I believe inflation is under control, I study arguments that suggest otherwise. This habit keeps me grounded and prevents overconfidence.

I also pay attention to behavioral signals. When financial news becomes overly optimistic or fear dominates headlines, I know sentiment is extreme. These aren’t reasons to buy or sell on their own, but they serve as warnings. Extreme optimism often precedes corrections. Extreme fear can signal oversold conditions. I don’t act on emotion, but I use these moments to double-check my positions.

Adaptation also means accepting that some strategies will underperform. There are years when dividend stocks lag behind growth stocks, or when real estate stagnates. I don’t abandon my approach during those times. I stay the course—but I remain open to refinement. Maybe I adjust my allocation slightly. Maybe I explore new income sources. The goal isn’t perfection, but resilience.

This mindset—flexible but not reactive—is what keeps me on track. I’m not trying to outsmart the market. I’m trying to understand it well enough to navigate it with confidence. That’s the final edge. It’s not about being the smartest investor in the room. It’s about being the most disciplined, the most prepared, and the most willing to learn.

Retiring early isn’t about luck or timing the perfect exit. It’s about building a system that sees ahead, withstands shocks, and funds your life—quietly, consistently. Market prediction, done right, isn’t gambling. It’s preparation. And when you stop guessing and start positioning, freedom stops being a dream and starts being a plan.